Have you made the big decision about the next step?

The process of buying a home through a mortgage seems difficult and complex, as endless questions arise in your mind:

- What type of loan is suitable for my case?

- What will be the interest rate?

- How much will the installment be?

- How many years will I need for repayment?

- What should be the maximum amount of the property I will buy?

- Which bank should I choose?

- Will I be able to pay my installments in the future?

A Mortgage Broker whom you can trust to answer all your questions is the solution to your concerns.

We are here to take care of everything for you.

As a mortgage issuance intermediary, IMS helps you make the right moves to quickly and easily release your loan. We dedicate the necessary time to:

- Fully understand your needs

- Assess your creditworthiness

- Present all possible options from the banking market

- Educate and advise you securely to formulate the best solution for your unique case

- Ensure the most suitable loan for you

Most importantly, we are by your side, taking on the entire process, and providing you with personalized service.

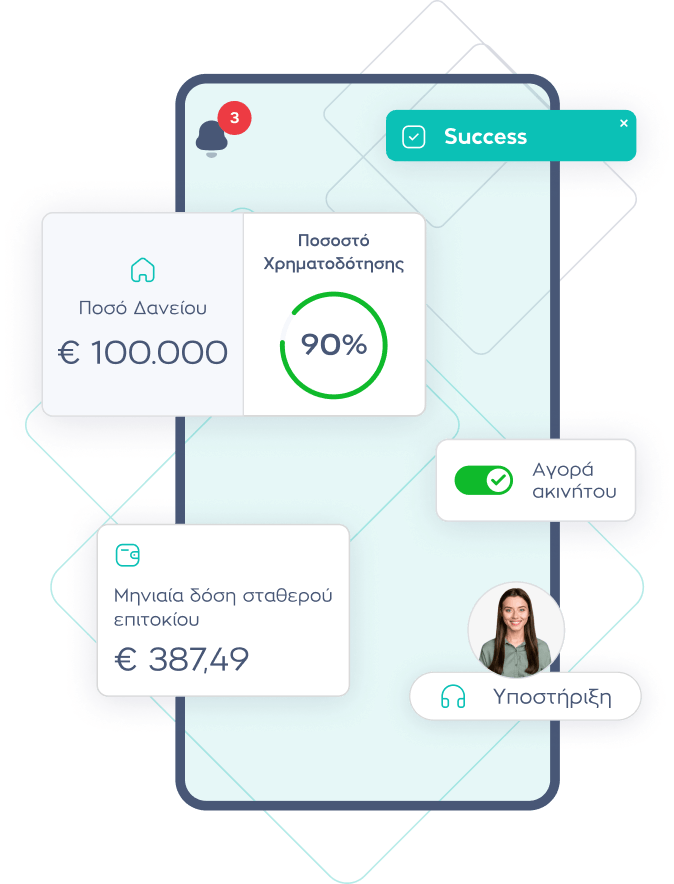

Now you can start your mortgage loan application online!

IMS provides you with all the necessary tools for quick and easy loan disbursement:

- Submission of a mortgage loan application

- Tracking the status of your application with updates at every stage

- Notifications and reminders for required actions

- Submission of supporting documents

- Loan installment calculation with detailed information, reminders, and repayment scheduling

- Immediate creditworthiness check

Our 25 years of professional experience

and our specialization in mortgage brokerage ensure effectiveness for our clients. Maintaining partnerships with major Greek banks, we possess excellent knowledge of the banking system. Acting impartially and always in the interest of the prospective borrower, we can provide them with an environment of security, functionality, continuous updates, and very high success rates for their loan application.

IMS is the largest Mortgage Broker in the country, having obtained an official license from the Bank of Greece.

The 7 steps for your home

For the issuance of your mortgage loan, seven basic stages are followed, in which the qualified IMS consultants will guide you safely, consistently and with absolute knowledge of the procedures.

Next step, after your meeting with one of the IMS advisors, is to send your application to the bank of your choice for the amount you wish to be financed. IMS proceeds to gather your financial data, we prepare our report and send the request to the bank for evaluation. It is noted that in order to proceed with the pre-approval request it does not require that you have ended up with a property.

After the bank evaluates your financial profile, your request receives a financial pre approval. The financial pre-approval is an official bank form, on which is written the amount pre-approved by the bank of your choice, with a specific time validity. It essentially confirms that it agrees to finance you for the amount you requested.

Having received the financial pre-approval and once you have settled on a property, the bank will proceed with its inspection. The bank’s lawyer checks the legal status of the property, the engineer checks that it is urban planning legal and will assess its current commercial value, based on which the final loan amount will be finalized.

After finalizing the financing amount, your request receives final approval, the bank form that essentially guarantees you the granting of a specific loan amount. You can now safely proceed to sign the purchase contract for the property.

The final approval is followed by the signing of the property purchase contract, its transfer to the mortgage registry / land office and its presentation to the bank. The bank checks the purchase contract and the borrower’s file again. The signing of the loan agreement essentially formalizes the terms and conditions of granting the housing loan.

After signing the loan agreement, there is an appointment with the bank’s lawyer in order to proceed with the registration of the pre-notation on the property purchase. Essentially, the pre-notation note is a form of mortgage and secures the bank, as it acts as a guarantee for the amount of the loan granted to the borrower.

The last step of the process is the disbursement of the amount to the customer’s account, who by issuing a two-line check pays the seller of the property and the mortgage loan process is completed by presenting the notarized payment deed to the bank.

The 7 steps for your home

For the issuance of your mortgage loan, seven basic stages are followed, in which the qualified IMS consultants will guide you safely, consistently and with absolute knowledge of the procedures.

What mortgage are you interested in?

And yet, without any financial burden at all!

The services of IMS are absolutely free for its clients as it is paid exclusively by the banking institutions it cooperates with, after the loan has been disbursed. We never charge the borrower any additional fees, even if he changes his mind or withdraws from our services. The same applies to foreign residents who wish to purchase a property through a mortgage loan in Greece.

Still have questions? We have the answers...

What is your experience in the mortgage sector?

What is the cost that I will have as a customer?

Why should I apply for Pre-Approval without having found a property?

What type of interest rate can I select?

Our biggest certification is our customers!

Read our dozens of reviews on Google Businesses attesting to the reliability and effectiveness of IMS:

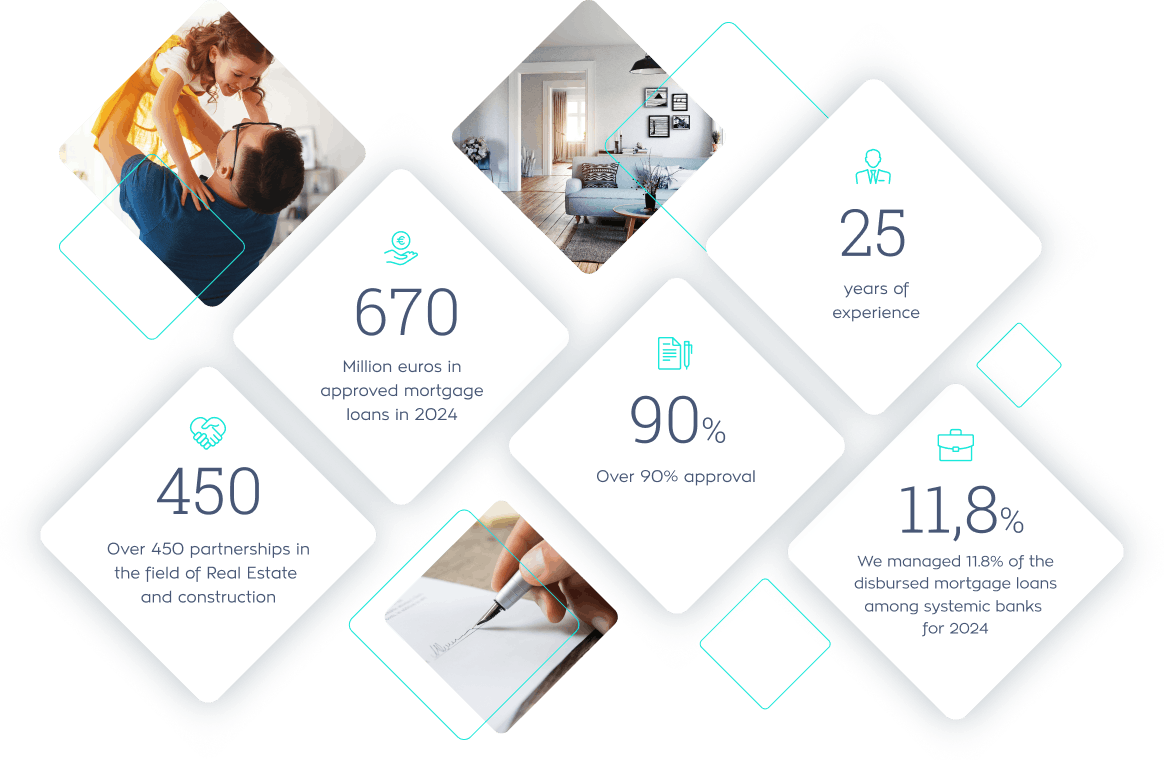

450

Over 450 partnerships

in the field of

Real Estate and construction

670

Million euros in

approved mortgage

loans in 2024

90%

Over 90% approval

25

years of

experience

11,8%

We managed 11.8% of the

disbursed mortgage loans

among systemic banks

for 2024